How to Set Up an IRS Short-Term Payment Plan

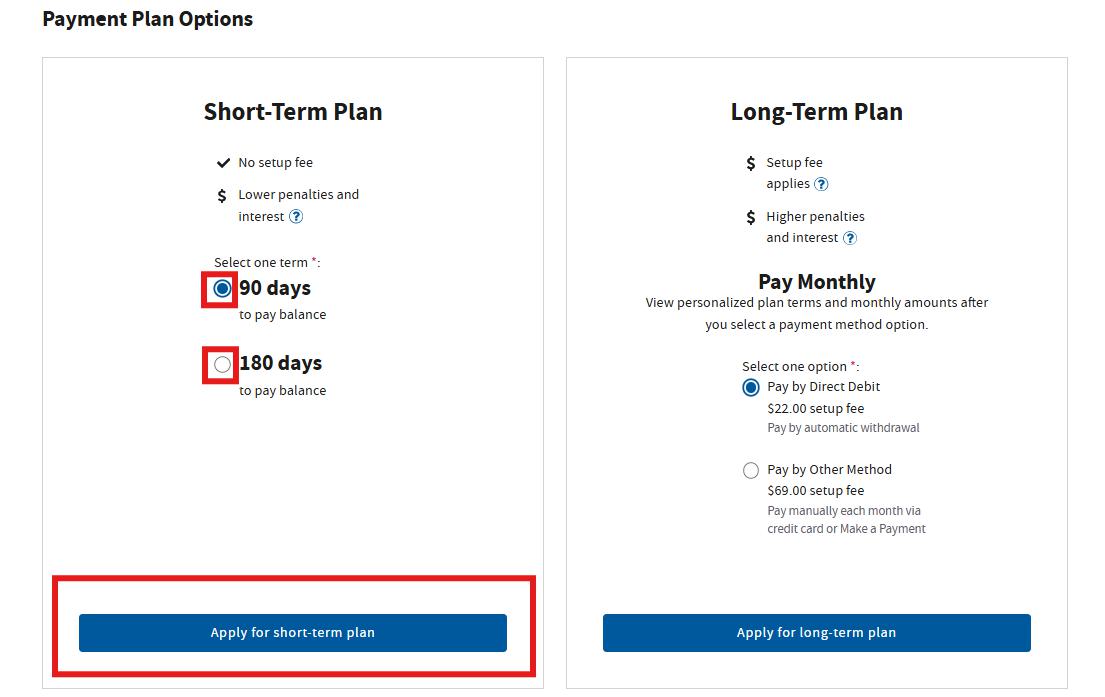

One of the payment options allowed by the IRS for Individuals with a balance due of less than $100,000 in combined tax, penalties and interest is a Short-term payment plan. A short-term plan is meant to have the entire balance due payment (plus accrued penalties and interest) paid to the IRS in 180 days or less.

Short-Term payment plans with the IRS have a $0 set up fee. The payments can be made to the IRS directly from your checking or savings account using Direct Pay (no fees), or by check, money order or debit/credit card (for an additional fee).

Here’s how to apply with the IRS for a short-term payment plan:

- Login to your account (or create an account) on the IRS website.

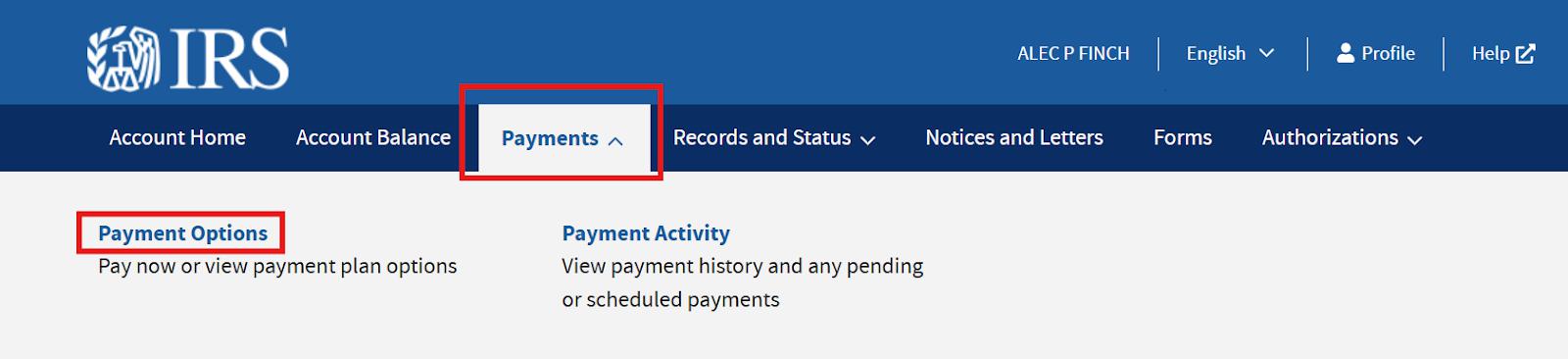

- Hover over the Payments tab and select Payment Options.

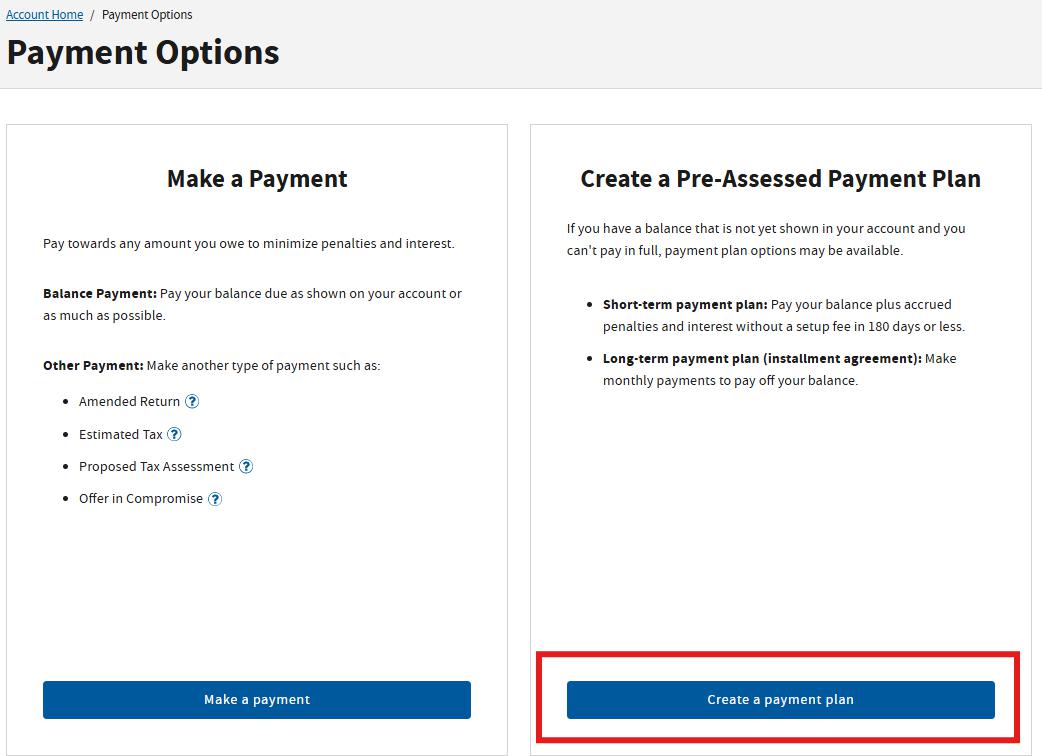

- Click the blue Create a payment plan button.

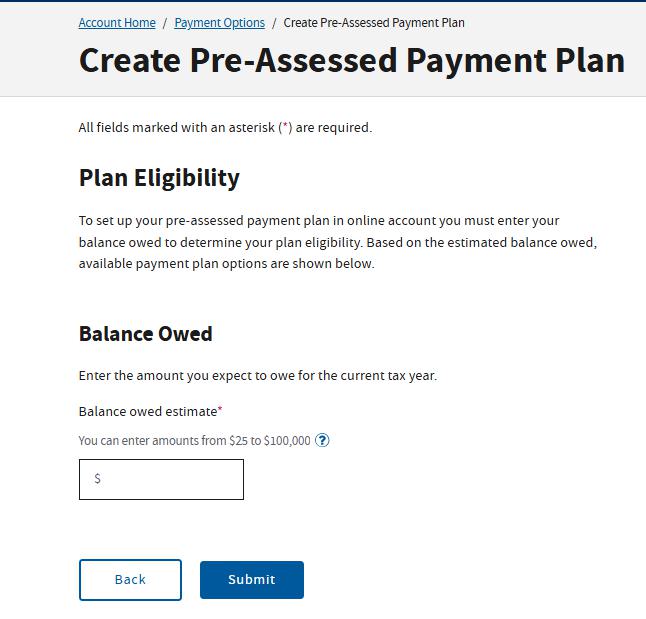

- Enter your balance owed on the Plan Eligibility page.

- Select the desired term of your Short-Term Plan, then click the blue Apply for a short-term plan button.

- Once the IRS finishes reviewing your pending request, you should receive additional correspondence about your plan. Payments will be able to be completed through your IRS account in the Payments section of your account.