How to Make a Texas Franchise Tax Payment

Here are the payment options the Texas Comptroller offers for payments.

1) WebFile (https://comptroller.texas.gov/taxes/file-pay/)

- Login to the WebFile for Texas Comptroller. If you do not have a login, you will need to create one with your Franchise Tax Number. If you do not know your Franchise Tax Number, you will need to call the comptroller at 800-252-1381. For privacy and data security reasons, we aren't able to call on your behalf.

- Click your Taxpayer Account for Franchise Tax.

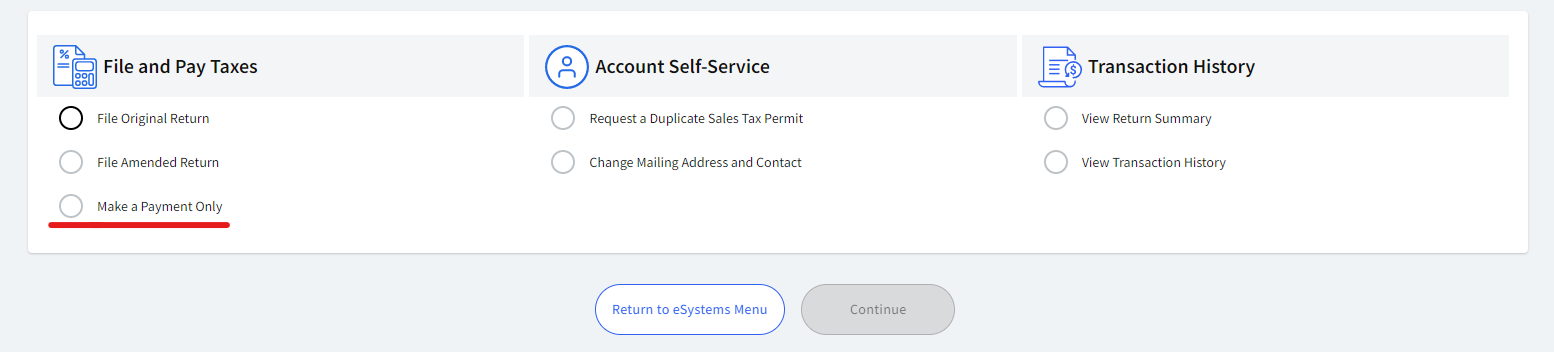

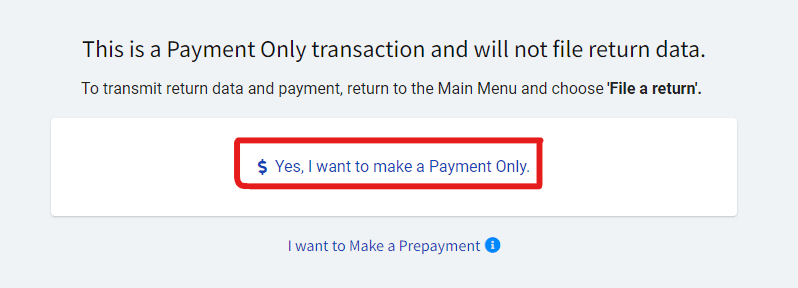

- Choose Make a Payment Only (your return has already been filed on your behalf) and Click Continue.

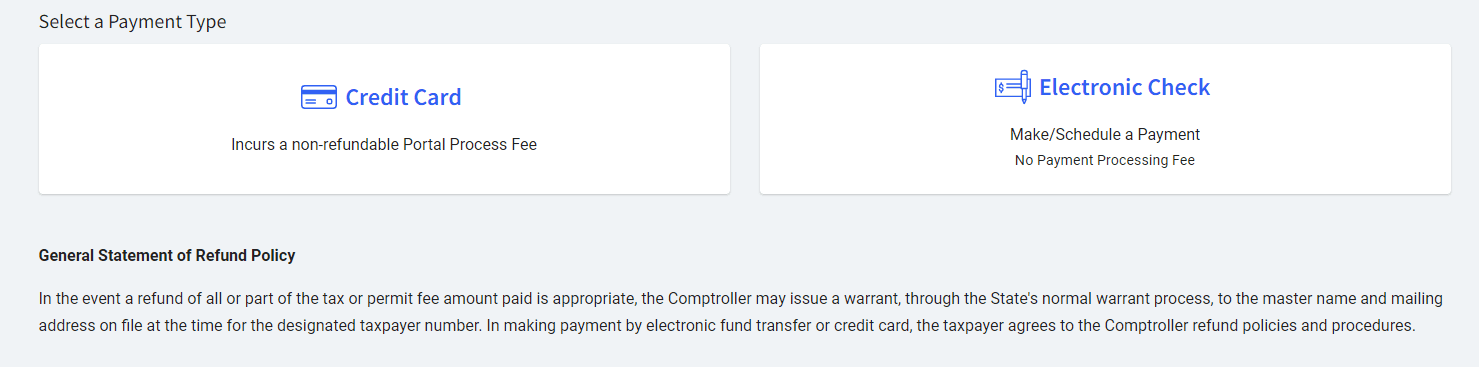

- Select Method of Payment (Credit Card will have fees):

Input the Amount on your Texas Franchise Tax Return under Amount to Pay on the first page of your Texas Franchise Tax return and then the Banking Information, along with an Effective Date (it is considered late after May 15th).

Click Agree and Continue and then Finalize the Payment on the next screen.

2) Pay by Check

- If you do not have access to the Texas WebFile system, you can use the Payment Voucher provided on your State Return and issue a check to the address specified along with the amount specified. Must be postmarked by the specified date. We strongly recommend using certified mail and/or some form of tracking to easily verify that your payment arrived.