How to Make a Payment to the IRS for a Balance Due

Here are a few payment options the IRS offers for Balance Due payments for Individual Tax Returns (1040s).

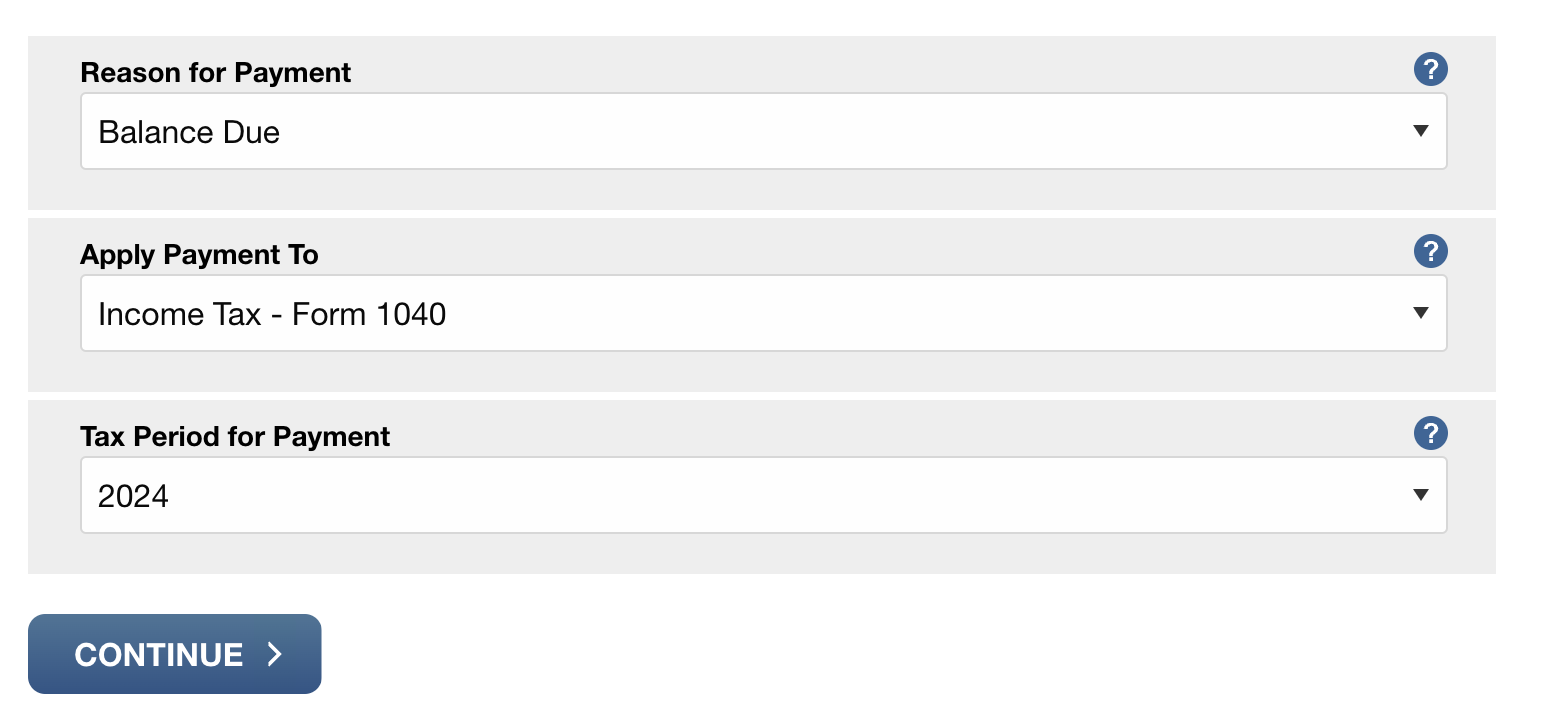

1) Direct Pay (https://www.irs.gov/payments/pay-personal-taxes-from-your-bank-account)

- Select the following reasons in the below image. (*Update “Tax Period for Payment” to the current year!*)

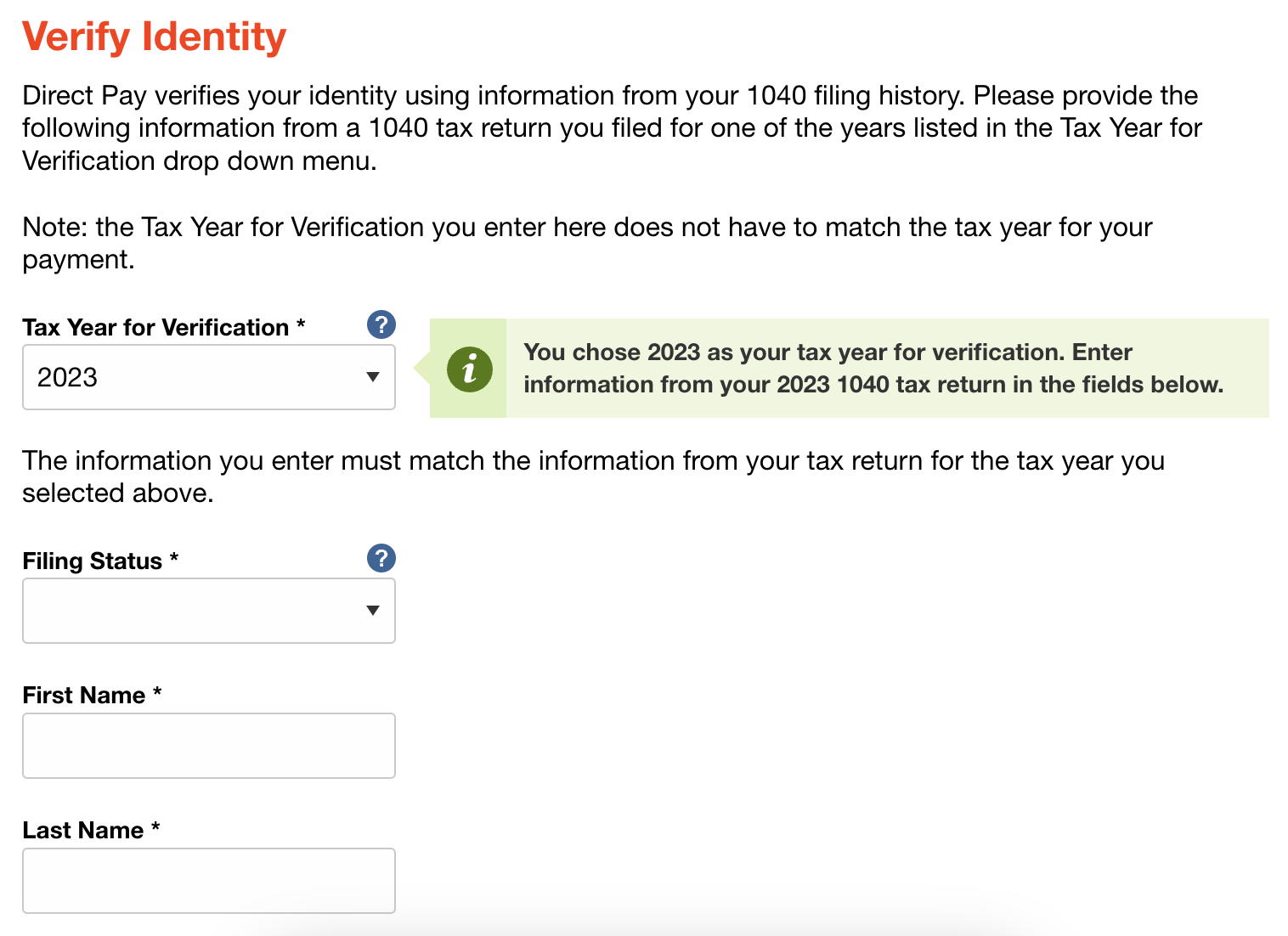

- Enter the prior year's information for the Tax Year Verification (Note: ideally you are using the most recently completed tax year for verification).

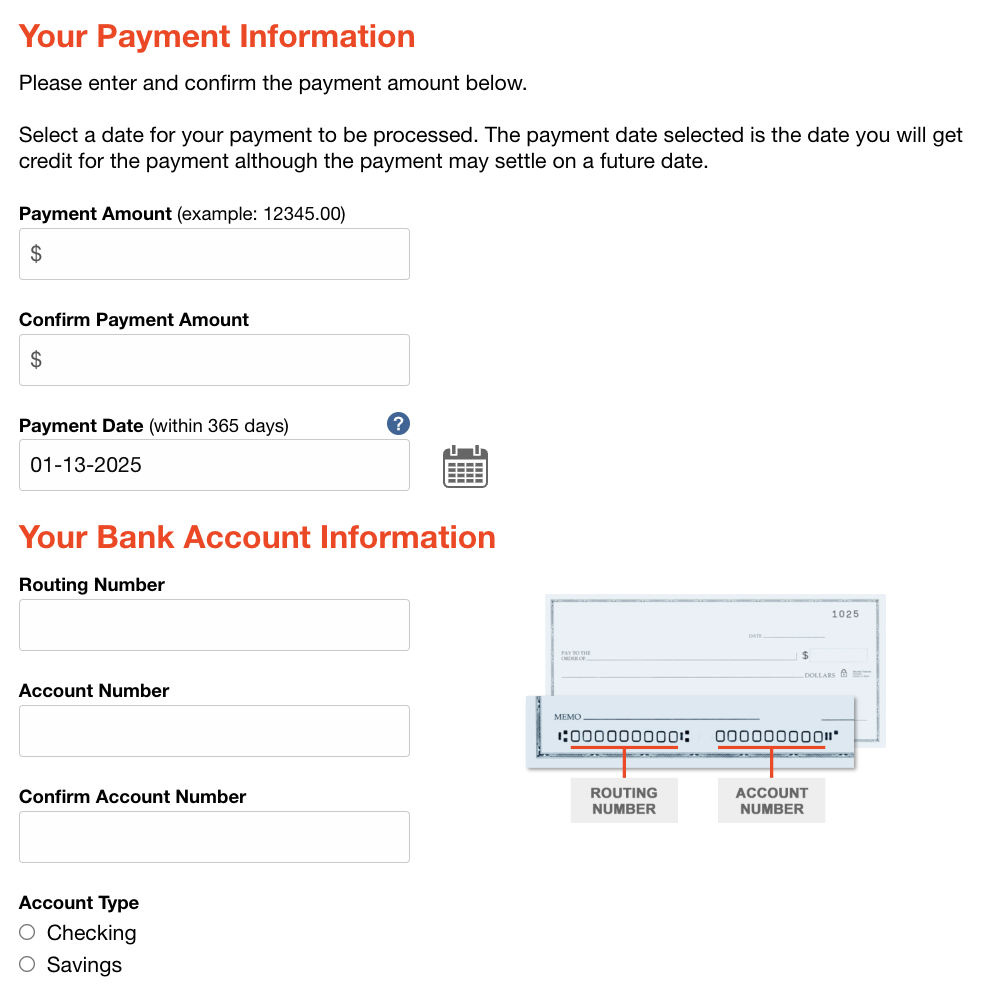

- Proceed through the final steps to remit the amount specified on the return. Contact our tax team (tax@jhandco.com) with any questions.

2) Debit or Credit Card (https://www.irs.gov/payments/pay-taxes-by-credit-or-debit-card)

- Choose Payment Processor (fees may apply). The payment will be for the Balance Due, applied to the 1040, and for the current year.

3) Check (https://www.irs.gov/payments/pay-by-check-or-money-order)

- Must be postmarked by Due Date specified for each year and should include the attached voucher. We strongly recommend using certified mail and/or some form of tracking to easily verify that your payment arrived. Please note, when mailing in documents to the IRS, there are delayed processing times. Please specify the Tax Year and SSN on the check. Electronic Payments would be strongly recommended instead of paying by check.

4) Installment Plan (https://www.irs.gov/payments/online-payment-agreement-application)

- Create an account and fill out the application. Installment plans cost a setup fee based on when you anticipate paying the balance due.