Seeking a Certificate of Account Status to Terminate Existence or Registration

The tax clearance letter is something that is created by the Texas Comptroller's Office after requesting a "Certificate of Account Status to Terminate Existence or Registration" on the Comptroller's Website. Here is how to request this certificate:

- Visit the eSystems login on the Texas Comptroller's Website

- If you don't have an account, you can create an account on the right side of the screen and hitting the blue "Create Profile" button

- If you don't have an account, you can create an account on the right side of the screen and hitting the blue "Create Profile" button

- On the Dashboard page, click "Assign Taxes/Fees"

- You’ll need the 11 digit number for your business (you can look it up here, or find in on a copy of your Texas Franchise Tax Report) and your franchise tax webfile number (this begins with the letters “XT” followed by 6 digits and is listed on the annual notice from the Comptroller’s Office)

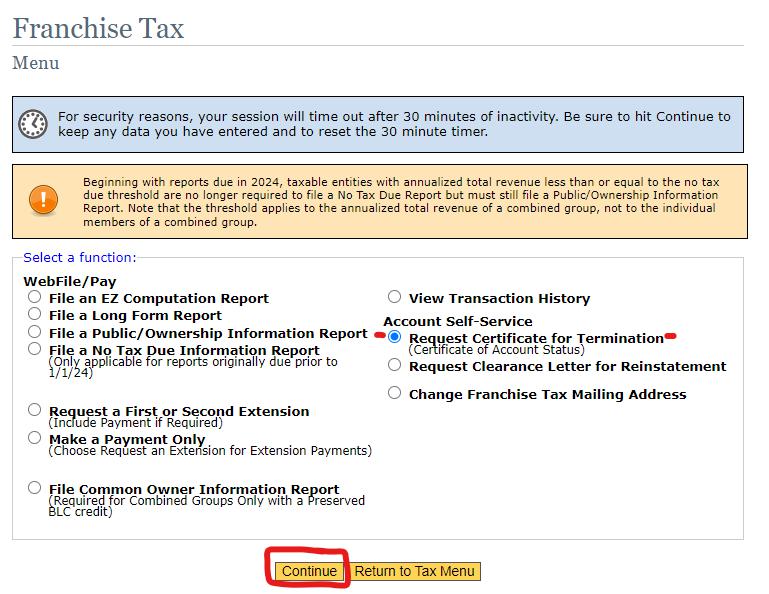

- On the Franchise Tax Menu page for the business, you'll select "Request Certificate for Termination" under "Account Self-Service," then hit the "Continue" button

- Choose "Request Certificate of Account Status to Terminate Existence or Registration", then hit the "Continue" button

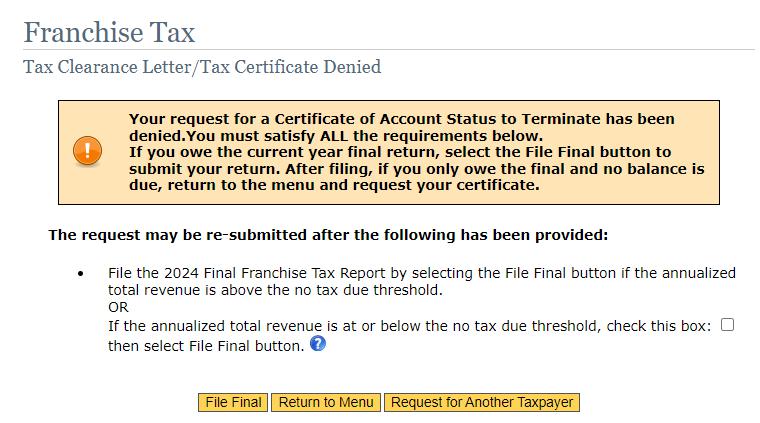

- The next screen will indicate that you need to file the "2024 Final Franchise Tax Report." If the annualized total revenue for the business is below the threshold of $2.47 million, you can check the box on the screen, then hit the "File Final" button.

Once the Comptroller's Office processes the Final Franchise Tax Report and the request for a certificate, you should receive a tax clearance letter from the Comptroller.