Finance Forward Blog

Who Is Required to Send 1099s?

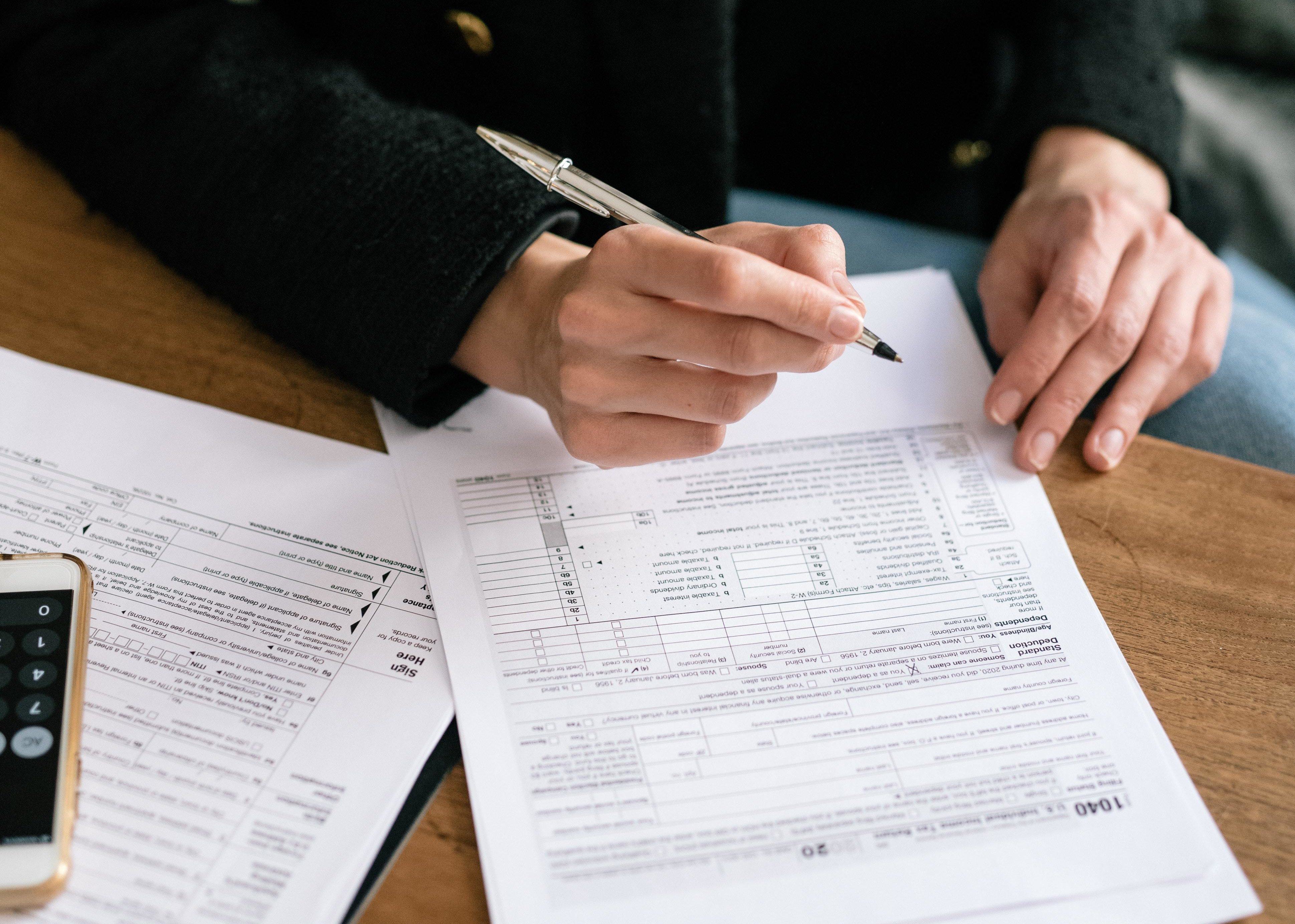

Filing tax returns can be quite a tedious process, especially if you’re doing it entirely on your own without an accountant. This process is even lengthier if you’re running a small business. This is why it is always recommended to hire a CPA to ensure all your taxes are filed correctly and on time every time.

You have to ensure your bookkeeping is in the correct order so that you can do proper tax planning with your accountant. If your taxes are not filed properly and do not adhere to state and federal laws, you could incur hefty penalties. This is especially important for individuals running a small business.

Numerous tax laws can apply to small businesses at both the state and federal levels. These must be followed to ensure that your business continues to run smoothly. One of the main laws relevant to the taxation of a small business is the filing of a 1099 form.

Many small business owners struggle with understanding how to fill and file the 1099 form, often incurring penalties and fines in the process. If you would like to know more about this common yet confusing form, here is a short guide to understanding the 1099 form and whether you should send it or not.

What Is a 1099 Form?

To begin with, let's get a general overview of what the 1099 form is. 1099 is a form used for filing non-employment income for federal taxation at the Internal Revenue Service (IRS). It is known as the “Information Filing Form.”

There are about 20 different variations to the 1099 form, and going into detail about each variation is not within the scope of this article. However, the most relevant 1099 form for small businesses is the 1099-NEC. The details of this should be well known to all small business owners and the hired accountant, if any.

According to the IRS, any payment that has been made by either a self-employed individual or small business within the financial year must be reported in the 1099 information filing form.

Furthermore, receipts of certain types of payments made by small companies or self-employed individuals could also mean that you are eligible to file a 1099 information return form. Any payment made to contractors that is more than 600 USD and has been made within the calendar year will require you to fill out a 1099-NEC form. If the necessary forms are not filled in due time or according to guidelines, due penalties are applied accordingly.

The following are some important new regulations regarding the 1099 form:

- The 1099-NEC Non-Employee Compensation form was introduced. According to instructions, companies must fill out the 1099-NEC form for every individual who has paid a minimum sum of 600 USD within the fiscal year. It is important to note that the payment made is for services provided to the business. The person the payment is made to is not on the company’s payroll. Payments made for personal expenses or use may not be filed for.

- Another form, the 1099-MISC, is filled for payments of above 600 USD that are made for miscellaneous purposes and are reported as various income payments on the 1099-MISC form. Some examples of these include prizes, awards, rents, and utility payments.

- You cannot simply download the 1099 forms from the internet. The original version that you must order and pick up from the IRS is scannable, whereas the printed online versions are not. Submitting a printed form from the IRS website that is not scannable will incur a fine.

Some states have different requirements for the 1099 forms, particularly the 1099-NEC forms, and require that you file these with the state. The following states have this requirement: DE, CA, KS, HI, MT, MA, OH, NJ, OK, PA, OR, RI, WI, and VT.

Always ensure that you follow both state and federal laws while filing taxes and 1099 forms. Any CPA hired by a small business will be well aware of the state and federal laws.

However, some business owners who try to file their taxes and information themselves often do not abide by the provided guidelines and incur heavy penalties. Furthermore, companies also make the rookie mistake of not paying penalties or not paying them on time, which increases the fine amount.

Important Types of 1099 Forms for Business Owners

Some important types of 1099 forms for investors and business owners are as follows:

- 1099-DIV (Dividends and Distributions): This form is used by large financial institutions such as banks. It is used to report distributions such as dividends to both the involved taxpayers and the IRS. This form is vital for C-Corporations that have shareholders. It is used to report and file the payments made to shareholders and investors.

- 1099-INT (Interest Income): This tax form reports Interest income. Any individual that “pays” lenders or investors an Interest Income at the end of the fiscal year must file using this form to report to the IRS.

- 1099-R (Distributions): This form is important for individuals who have received distributions above 10 USD during the calendar year. These include retirement benefits, profit-sharing plans, contracts with insurance companies, survivors’ pensions, pensions, annuities, charitable gifts, permanent or total disability covered by life insurance policies.

Who Has to Send 1099s?

Any business that pays independent contractors a sum above 600 USD during the financial year must fill and send the 1099 form. In simpler words, the payer or the small business owner hiring the independent contractor has the responsibility to fill and send the 1099 form.

If you are an independent contractor, it is not your responsibility to fill and file the 1099-NEC form. The form has two copies, Copy A, which must be given to the IRS, and Copy B, given to the independent contractor. Independent contractors who have not received their copy of the 1099-NEC form must follow up with their clients as they will need it to file their tax returns.

Note: If you have more than 250 1099 forms, you must file them electronically. Unless you have a waiver, you will be fined for non-compliance. However, if you have less than 250 forms, you can file them on either paper or electronically.

Small business owners must file the 1099-NEC form if they have made any payments above 600 USD for purposes mentioned in the list below as given by the IRS:

- Any service for which an independent contractor or someone not an employee for the company was used. This includes materials and parts other than services, as well.

- Any payment made to a legal service provider, including law firms and attorneys.

- Any cash payments made to purchase aquatic life from businesses or individuals that participate in the business of catching or trading aquatic life, especially fish.

An important note to remember is that if for some reason you have withheld federal income tax, in accordance with the rules for backup withholding. This shall be done for all amounts of payments made, no matter how small or big they may be.

The 1099-MISC, on the other hand, must be filled if payments have been made for the following purpose:

- Royalties

- Rents

- Awards, prizes, or any other such forms of income

- Federal Income tax withholding and backup withholding

- Healthcare and medical services

- Proceeds from crop insurance policies

- Proceeds for fishing boats

- Any payments that are made as a substitute for interest or dividends

- Proceeds are paid to attorneys for procedures such as settlements. Here it must be noted that the attorney fees paid for services will be reported on the 1099-NEC form.

- The purchase of fish for reselling purposes

- Any deferrals mentioned in Section 409

- Deferred compensation that is non-qualified

The 1099 form has numerous boxes. Ensure that you are putting the payment in the correct form before filing the form.

Who Does Not Have to Send 1099s?

The list for individuals and entities that are not required to file 1099 includes the following categories:

- You are not a business owner and do not engage in trade

- You are a business owner or engage in trade, however

- Payments made were below 600 USD

- The vendors are operating as C-Corporations or S-Corporations, including LLC or other partnerships.

- Payments are made by credit or debit cards or third parties such as PayPal (these payments are reported by the third parties and credit card companies themselves through the 1099-K form)

- The vendors are of freight, storage, merchandise, and other sellers of similar services or items

- Payments of rent were made through real estate agents or property managers. (If you are making payments to Landlords directly, then you must fill the 1099 form)

Conclusion

Filing taxes within the given time frame of the IRS and in proper order is of utmost importance. This ensures the smooth running of a small business and saves it from unnecessary fines.

Therefore, before filing taxes, ensure that your bookkeeping is in order and your accountant is well aware of all your business-related transactions and payments. This will help you file the 1099 information filing form with the IRS appropriately.

Final Thoughts

If any of the information provided above made you feel confused, don’t stress because you are not alone. There are many other businesses that have faced similar problems in the past. However, with time, they have fared well with just a little help.

If you are struggling or just don't have the time to keep up with it, it may be time to have J. Hall & Company take over and invest with accurate accounting records and financial reports. The J. Hall & Company team will manage your records from start to finish and make sure all adjustments are timely recorded. This option is also feasible for small businesses because it is cheap and hassle-free, at a fixed monthly rate. Contact us today for a free quote!