Approving Power of Attorney (POA) Authorizations

Power of Attorney enables an authorized individual to represent you in tax matters before the IRS. Here is how to approve a Power of Attorney application on the IRS website:

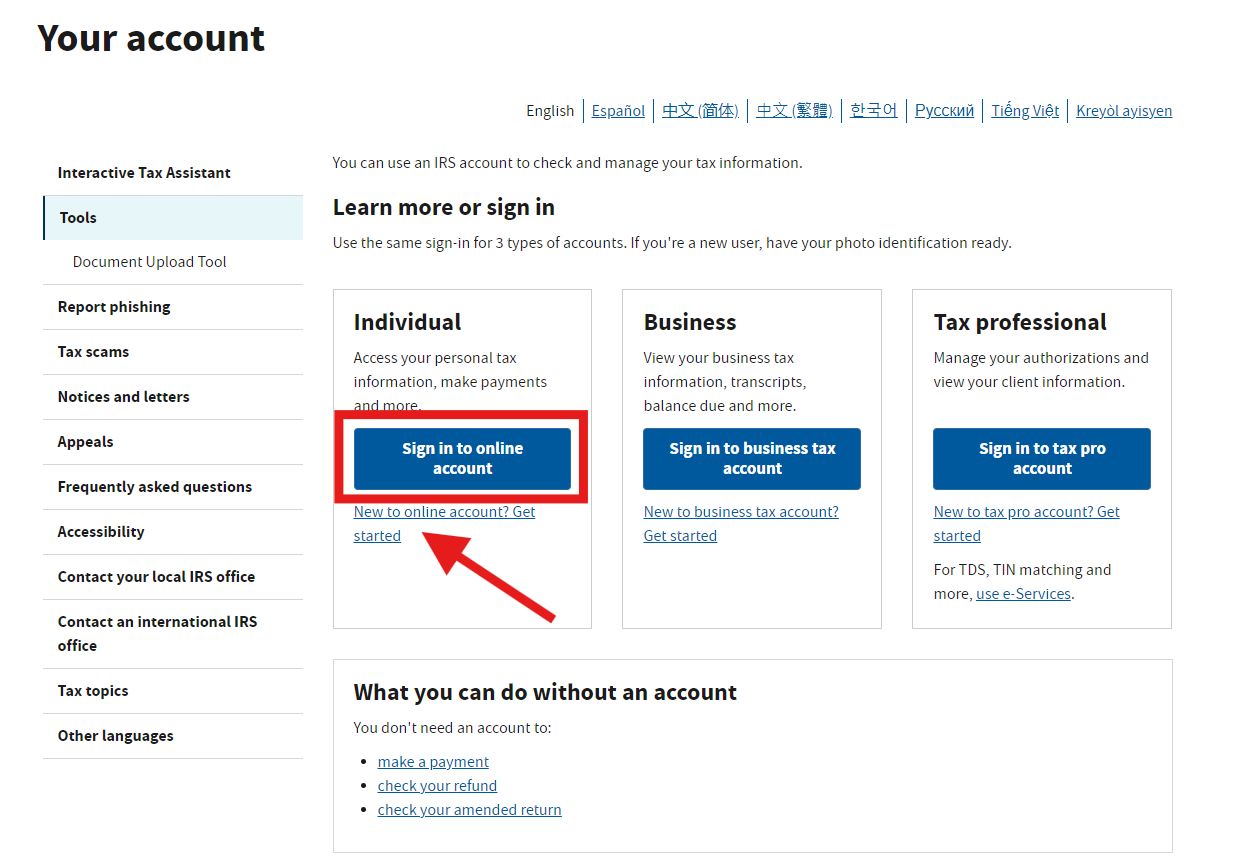

- Visit the IRS website and login to your individual IRS account. If you don’t already have an individual account, you can create one by clicking the button just below the blue “Sign in” button, where it says "New to online account? Get started".

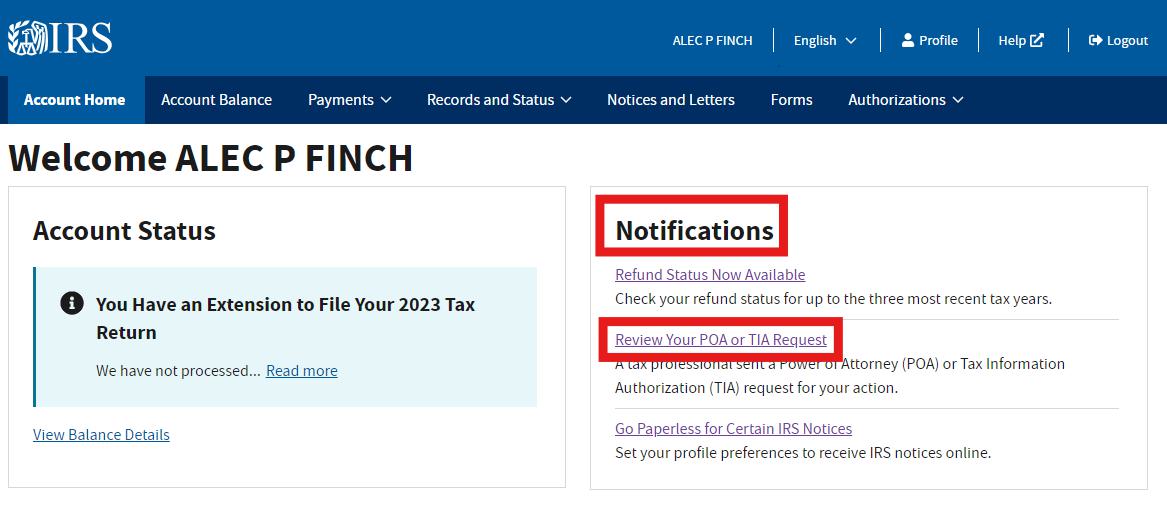

- Once you are logged into your account, on the Account Home page, you should see a Notifications section on the right side of the screen, and one of the options should say “Review your POA or TIA Request”—click there. If you don’t see this, you can also click on “Authorizations” at the top of the screen, then “Power of Attorney and Tax Information Authorizations.”

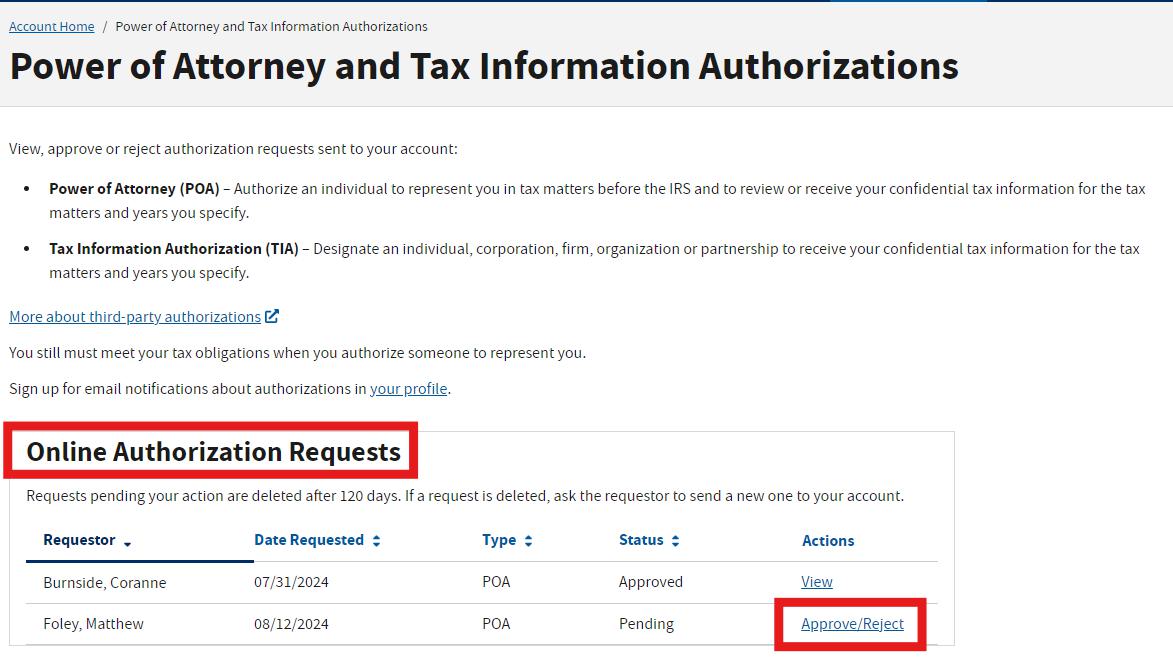

- On the Power of Attorney and Tax Information Authorizations screen, find the Online Authorization Requests section. You should see requests from “Foley, Matthew” and “Burnside, Coranne” from our tax team. Under the Actions column, click on “Approve/Reject” for either Matt or Cori–you’ll have to approve the POAs individually, so you’ll need to come back to this screen twice.

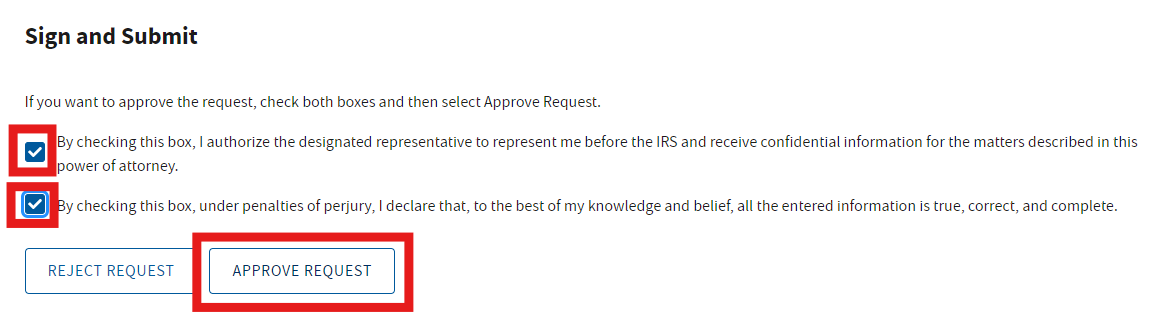

- Scroll down to the Sign and Submit section. There will be two boxes to check, then click on the “Approve Request” button.

- After approving the request, you should see a green banner at the top of the screen stating “Request Approved.”

- Be sure to return to the Power of Attorney and Tax Information Authorizations screen and repeat the process for the other POA until you have approved the authorizations for both Matt and Cori.

You’re done! The IRS will process the POA applications in 3-5 business days.